Migration Analysis

Products and Services

| Credit Risk and Migration Analysis | ||||||

| The Increasing Credit Risk Challenge Regulatory oversight continues to become increasingly stringent due to the history of broad deterioration in asset quality, liquidity constraints, CRE and mortgage exposure beyond the sub-prime market, economic impacts on borrowers, and the influence of Basel.

Regulators consistently identify Risk Migration Analysis as a key component of the MIS tool set for managing and reporting on Credit Risk and establishing and substantiating ALLL. Risk Migration Analysis Risk Migration Analysis considers upgrades and downgrades in the credit quality of a subset or entire loan portfolio as well as the potential for significant financial stress and/or loan default. Historical Risk Rating Migration enables lenders to utilize their historical loan data to perform several mission critical activities, including:

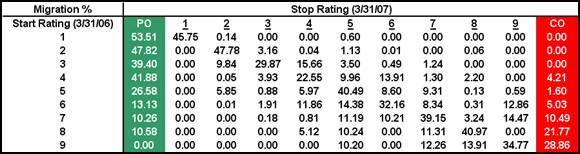

Historical Risk Migration (from 3/31/06 to 3/31/07) The Risk Migration Analysis System provides a powerful and intuitive tool for performing migration analysis at the portfolio, obligor and loan level including summary results and drill down detail.

Contact us for additional information on Migration Metrics Products and Services.

|